The Passive Investment Income Rules: Understanding the Impact on Your Business

With the increase in the capital gains inclusion rate from 1/2 to 2/3 effective June 25, 2024, passive investment income could be higher in your corporation. Now is the time to revisit the potential reduction to your small business deduction.

What is passive investment income?

Many small businesses may have earnings that they have retained in the corporation that are not needed for the ongoing business activities. These funds are placed in an investment account as a financial planning vehicle. Any income from that investment is called “passive investment income”. Dividends, interest and 2/3 of any realized capital gains are considered passive investment income.

At the same time, businesses apply the Small Business Deduction (SBD) when they file taxes. Canadian-controlled private corporations (CCPCs) are taxed at the small business rate for the first $500,000 of Active Business Income (ABI) (9% Federal tax rate). For amounts over $500,000, ABI is taxed at the general Federal tax rate of 15%.

Why were the passive investment rules introduced?

Because of the lower business tax rates versus personal tax rates, the Federal government felt that corporations could invest higher amounts than individual investors, which gave business owners an unfair advantage over individuals.

In other words, the business had more after-tax dollars to invest than if the money was withdrawn to a shareholder, personally taxed, and then invested. Although funds are taxed eventually when withdrawn from a corporation, the tax deferral advantage allows the investments to compound for years, resulting in a larger after-tax total down the road.

How do the passive investment rules work?

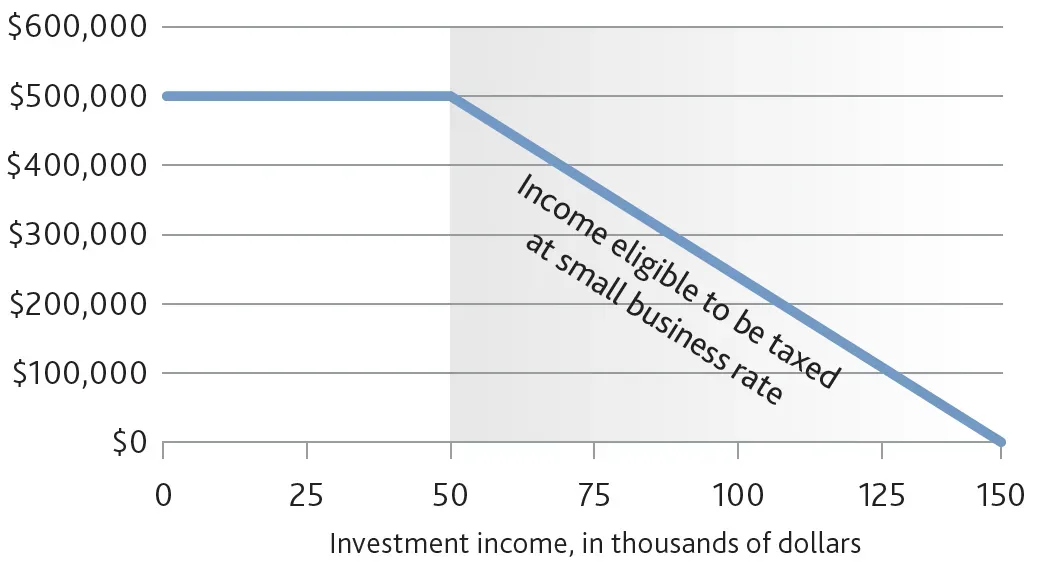

The rules set a threshold for how much passive income a CCPC (and corporations associated with it) can earn without the passive investment income reducing the corporation’s small business deduction. Basically, a CCPC can earn up to $50,000 per year and maintain the full $500,000 SBD. Every dollar of passive income above the $50,000 per year threshold will reduce the corporation’s SBD by $5 completely eliminating it once passive income is over $150,000*.

A simple example: A business with a $1 million portfolio that generates $50,000 of passive investment income, is onside and within the threshold. On the other hand, a business with a $2 million portfolio generating $100,000, would have its SBD reduced by $250,000.

What is the impact on your business?

In general, the income eligible to be taxed at the small business rate declines as your passive investment income grows, as shown in this chart:

The impact on your business will depend on your active income, passive income, and the province in which you do business.

Planning can be completed to maximize the small business deduction by reducing the corporation’s passive investments. This can be accomplished by reviewing the invest mix of the corporation’s assets and repaying shareholder loans, distributing assets to shareholders by way of capital or taxable dividends, or by purchasing permanent life insurance since the growth in the policy is not included in the passive investment calculation (unless the funds are withdrawn).

For more information on the passive investment income changes and how they will affect your corporation, check out this Passive Investment Income Calculator.

References

*The provinces also have an SBD and mirror the federal SBD reductions for passive income. However, Ontario and New Brunswick do not mirror the federal rules with respect to the reduction to the SBD so for these provinces, there is only the federal reduction and no corresponding reduction to the provincial SBD.